north dakota sales tax online

File the North Dakota Sales Tax Return You will do this with the North Dakota. Returns for small business Free automated sales tax filing for small businesses for up to 60 days.

Internet Sales Tax Definition Taxedu Tax Foundation

Filing Your North Dakota Sales Tax Returns Offline.

. April June Q2 July 31. If you only need to file a North Dakota sales tax return. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

An additional tax may be imposed on the rental of lodging and sales of prepared food and beverages. 31 rows The state sales tax rate in North Dakota is 5000. One North Dakota Login and password to access multiple ND Online Services.

NORTH DAKOTA SALES TAX PERMIT APPLICATION. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. North Carolina Phases Out Some Taxes Imposed On Manufacturers and Farmers.

July September Q3 October 31. Ad Download Or Email ND Form ST More Fillable Forms Register and Subscribe Now. E-Filing Free Filing.

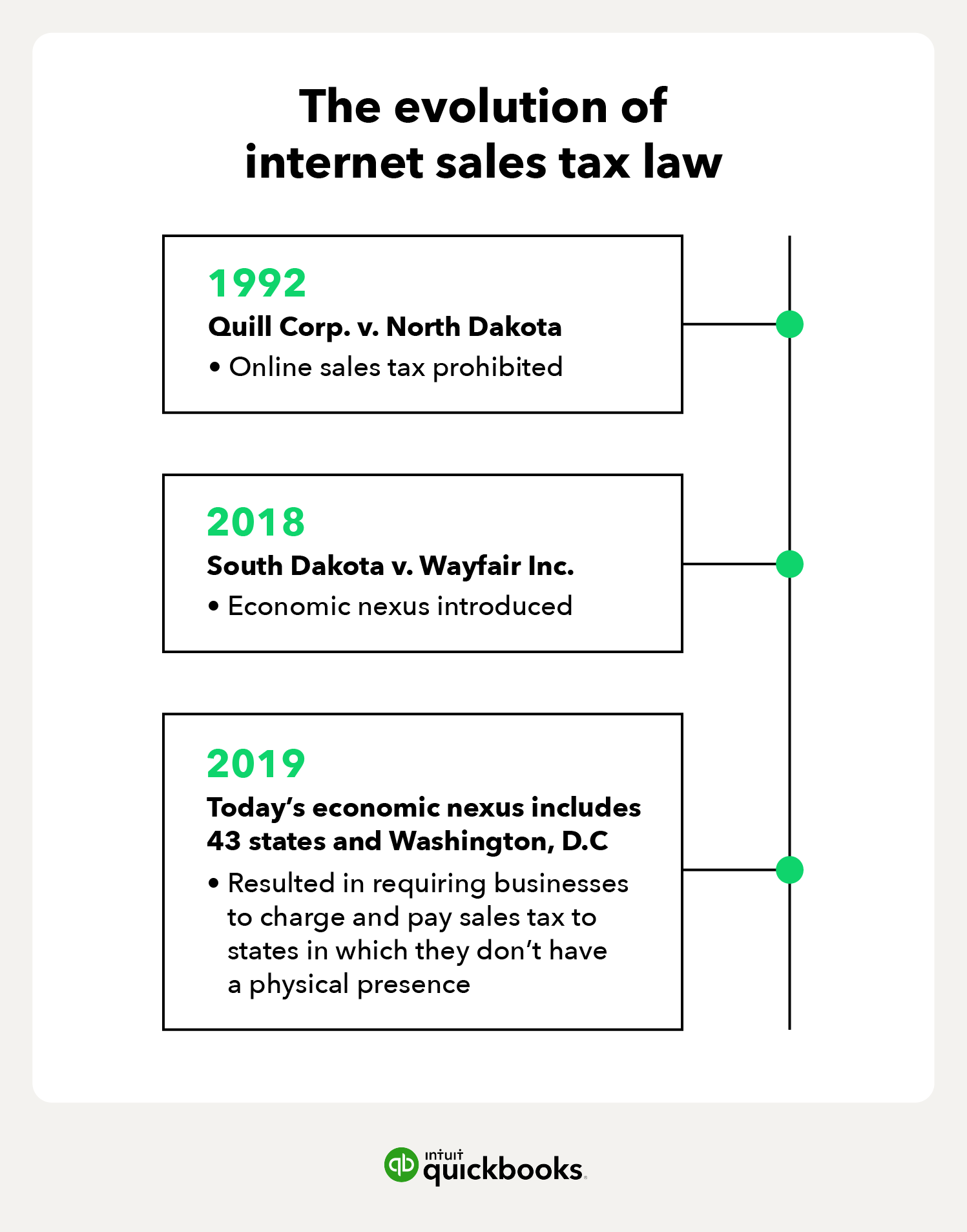

North Dakota requires businesses to file sales tax returns and submit sales tax payments online. North Dakota will be collecting sales taxes from online retailers in the wake of todays ruling by the US. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax Commissioner.

The North Dakota ND state sales tax rate is currently 5. North Dakota Tax Nexus. With local taxes the.

ND Combined State Local Sales Tax Rate avg 5728. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. Depending on local municipalities the total tax rate can be as high as 85.

Complete Edit or Print Tax Forms Instantly. The governing body of any city or county may by ordinance impose a city or county. Average Local State Sales Tax.

Unemployment Insurance Tax. The North Carolina sales and use tax of 26 on sales of electricity to manufacturing industries. Maximum Local Sales Tax.

This allows you to file and pay both your federal and North Dakota. October December Q4 January 31. North Dakota participates in the Internal Revenue Services FederalState Modernized E-File program.

Sales Tax Rate Information. January March Q1 April 30. This free and secure.

Sales and Use Tax Rates Look Up. No credit card required. Counties and cities can charge.

Supreme Court overturning a 1992 case that prohibited such collections. Register once for secure access to State services. With local add-on tax the combined sales tax rate can be up to 85.

Ad A brand new low cost solution for small businesses is here - Returns For Small Business. Ad Fast Online New Business Sales Tax Nd. North Dakota state sales tax rate is 50.

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Register for a North Dakota Sales Tax Permit Online by filling out and submitting the State Sales Tax Registration form. Sales Tax Taxpayer Access Point TAP North Dakota Sales Tax Taxpayer Access Point TAP is an option offered by the Office of State Tax Commissioner to all sales tax permit holders.

North Dakota assesses local tax at the city and county. Busineses with nexus in North Dakota are required to register with the North Dakota Department of Revenue and to charge collect and remit the appropriate tax. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up.

Fast Processing for New Resale Certificate Applications. While it is highly recommended that you file online using the North Dakota Taxpayer Access Point TAP website it is possible to file your. Ad A brand new low cost solution for small businesses is here - Returns For Small Business.

List of online stores that do not collect sales tax for orders delivered to North. Thursday June 23 2022 - 0900 am. We strongly recommend using a sales tax calculator to determine the exact sales tax amount for.

Ad Access Tax Forms. Local Jurisdiction Sales and Use Taxes. State Sales and Use Tax Rate.

ND State Sales Tax Rate. Maximum Possible Sales Tax. Groceries are exempt from the North Dakota sales tax.

800 524-1620 North Dakota State Sales Tax Online. North Dakota State Sales Tax.

Sales Tax By State Is Saas Taxable Taxjar

.png)

States Sales Taxes On Software Tax Foundation

North Dakota Sales Tax Information Sales Tax Rates And Deadlines

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

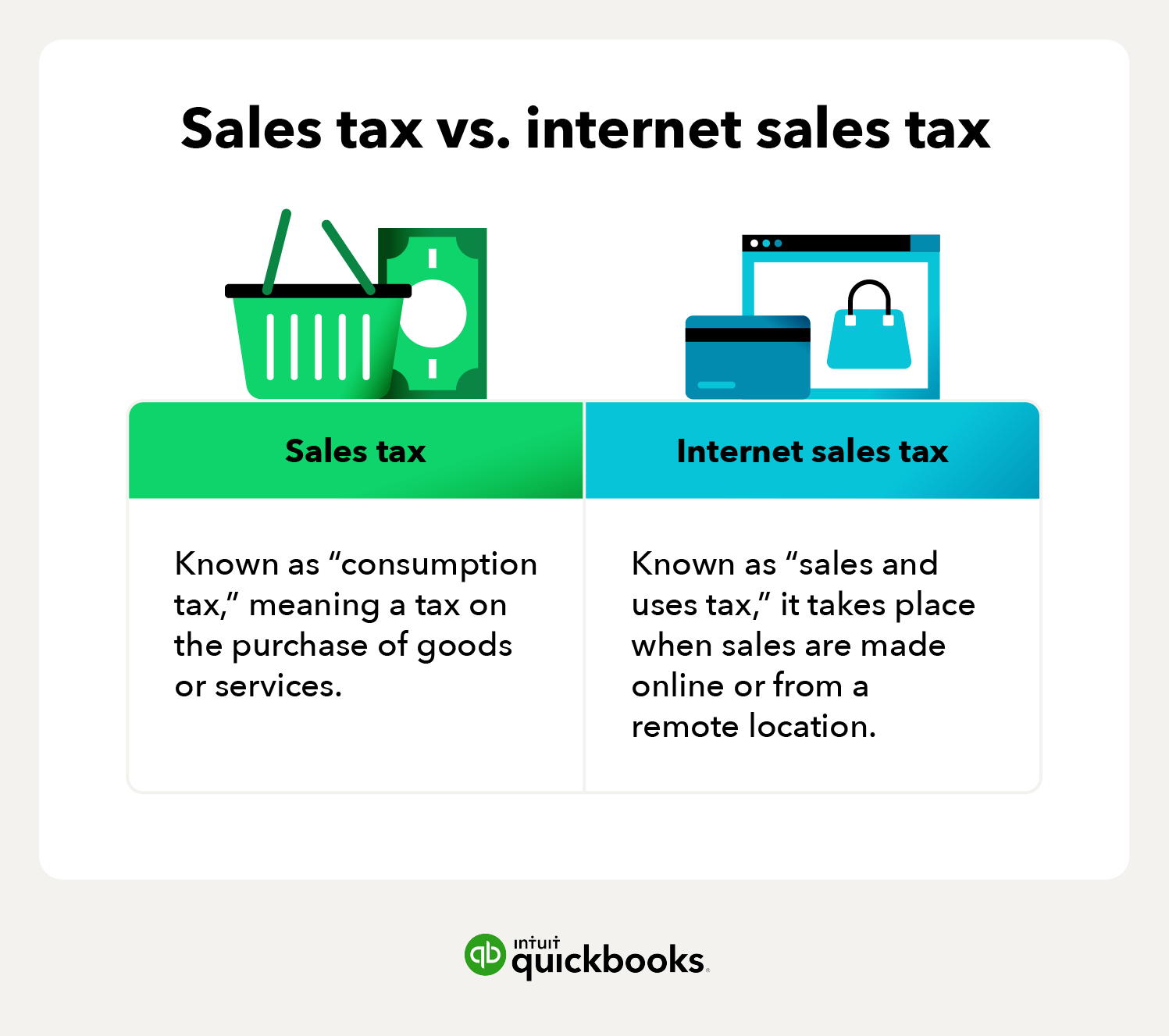

Internet Sales Tax Definition Types And Examples Article

Internet Sales Tax Definition Types And Examples Article

E Commerce And Sales Tax Youtube Sales Tax Commerce Ecommerce

How Do State And Local Sales Taxes Work Tax Policy Center

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

South Dakota Statute Of Limitations Personal Injury Malpractice And Wrongful Death Statutes Of Limitations In South Dakota

Central Indexing Ucc Secretary Of State

How To Register For A Sales Tax Permit In North Dakota Taxjar

North Dakota Sales Tax Handbook 2022

About The North Dakota Office Of State Tax Commissioner

Income Tax Update Special Session 2021

Sales Tax Guide For Online Courses

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation